.png?width=540&height=713&name=Communiqu%C3%A9%20(3).png)

(Long: 73495828188)

Private Bank

Resources

Discover us

of independent wealth managers.

At Piguet Galland, our strength lies in instilling peace of mind in every moment – present and future!

You manage your clients' financial assets and advise them, and we're here to support you in this process.

You, independent asset manager

Manage the relationship with the private client and implement a discretionary management mandate over the deposited assets.

Private client

Opens an account, deposits financial assets and benefits from GFI and bank services (excluding asset management).

We, Piguet Galland

Execute stock market transactions according to investment instructions and serve as the client's security custodian.

Tripartite relationship

Piguet Galland will continue supporting you in your daily tasks, allowing you to focus on advising your clients.

We are a human-scale bank backed by an extremely solid financial group. Our shareholder is Banque Cantonale Vaudoise, the 5th largest bank in Switzerland.

Our approach revolves around establishing a personal relationship with a dedicated and highly experienced team within the bank. We have collaborated with GFIs for over 25 years.

Our corporate culture fosters long-term relationships based on mutual respect and pursuing shared objectives towards our clients' interests.

We recognise the importance of human relationships and are dedicated to collaborating closely with you to help you achieve your goals. Alongside the tools we offer, this foundation of trust will enhance your capacity to provide customised services to your customers.

Julien Froidevaux

Head of Independent Managers

Julien Froidevaux has over 30 years of experience in banking and finance, with more than half of that time dedicated to serving independent wealth managers. He spearheads the development of the Bank's commercial presence in this sector and holds a doctorate in management from the University of Geneva, along with CFA and CWMA diplomas. Additionally, he has an ESG investment certificate from the CFA Institute and is an instructor for a Master's degree program in Finance at HEC Lausanne.

.png?width=210&height=165&name=Group%20316126896%20(7).png)

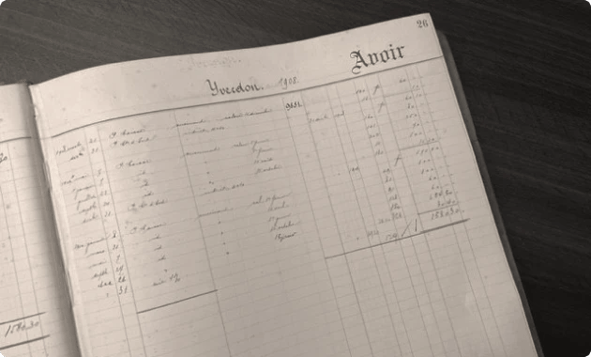

A strong legacy

Established in French-speaking Switzerland since 1856, we're a private bank specialising in global wealth management. If we had to sum up our business model in one word, it would be 'proximity.'

A major financial group

Piguet Galland offers the best of both worlds: we combine the independence and speed of execution of a human-scale structure with the stability and AA rating of our parent company, BCV Group.

We prefer simple, lightweight solutions so that you can obtain the information you need to monitor the accounts you manage.

Opening an account

All of the Bank's account opening documents are available on a dedicated cloud, whether for individuals or legal entities, in French or English.

Security deposits

Our custodian bank service ensures the security and management of your clients' deposits. The Bank takes care of the safekeeping and management of your security deposits.

Placing stock market orders

Your stock market orders are transmitted to our dealing room for execution. An intuitive PMS is available for placing orders and consulting client portfolios.

eBanking service for private clients

All the bank's private customers can access their accounts anytime via an eBanking application. They can also place all their payment orders via the application (QR code).

Consulting bank documents

Access all portfolio statements, tax statements and transaction notices at any time. Documents can be printed and are saved in the ebanking application.

Sending data

All client portfolio positions and transactions can be provided in the form of a daily data file, allowing seamless integration into various consolidation and transaction systems.

Rely on the Wealth Advisory team's expertise.

Learn moreOur wealth solution experts are here to help you and your clients with their projects. We provide an initial complimentary consultation along with a comprehensive wealth assessment.

Additionally, if necessary, we can also provide expertise in areas such as:

Pension solutions

Learn moreBanque Piguet Galland has put together a comprehensive range of pension products to satisfy you and your most demanding customers:

We will choose the most suitable solution from our partner foundations. You have two options:

A pension fund tailored to your company

Learn moreOccupational pension provision is vital to your company's social policy and the foremost means for tax optimisation. A customised pension plan that matches your professional and personal requirements is essential.

Our pension experts eagerly explore various structures, viable investment strategies, and your preferred level of engagement.

Discover our wide range of financial instruments that can help your clients achieve their investment objectives and diversify their portfolios.

Investment funds & ETFs

Our funds, expertly managed by the Piguet Galland investment team, provide a focused investment approach grounded in diverse strategies.

Thematic certificates

Thematic certificates provide precise exposure to specific sectors or emerging trends, allowing investors to participate in the growth of promising investment themes such as renewable energies and cutting-edge technology.

Best Workplaces™ Switzerland 2024

Piguet Galland has been named one of Switzerland's best employers by the ‘Great Place To Work’ organisation.

Learn more

Best Swiss Private Bank HNW Team (Swiss Domestic Clients) 2024

The WealthBriefing Swiss Awards recognise the quality of service provided to Swiss HNW clients.

Learn more

Best Swiss Private Bank 2023

International bankers voted Piguet Galland the best Swiss private bank for the third consecutive year.

Learn more

Fair-ON-Pay Advanced

Piguet Galland is once again certified Fair-On-Pay Advanced in 2023, thanks to pay equity with less than a 2.5% gender pay gap within the company.

Learn more

B Corp™ Certification

In 2023, Piguet Galland obtained B Corp certification. The Bank proves its commitment to Corporate Social Responsibility.

Learn more

Great Place To Work

Piguet Galland certified Great Place to Work® Switzerland 2023. The human scale, values, working conditions and management proximity are particularly appreciated.

Learn more

Best ESG structured product

The Helv-ethic certificate managed in partnership with BCV, won Best ESG product at the Swiss Derivative Awards.

Learn more

Best Swiss Private Bank HNW Team (Swiss Domestic Clients) 2023

The WealthBriefing Swiss Awards recognise the quality of service provided to Swiss HNW clients.

Learn more

Best Swiss Private Bank 2022

International Banker voted Piguet Galland the best Swiss private bank for the second year running.

Learn more

Best fund for Piguet Fund - Pondéré CHF

The Piguet Fund - Pondéré CHF was again named the best fund in its category at the Refinitiv Lipper Fund Awards 2022.

Learn more

Meilleure banque privée suisse 2021

Piguet Galland est élue meilleure banque privée suisse par International Banker.

Learn more.png?width=540&height=713&name=Communiqu%C3%A9%20(3).png)

(Long: 73495828188)

.jpg?width=410&height=260&name=Group%20316127846%20(1).jpg)

(Long: 73495828188)

(Long: 73495828188)

(Long: 73495828188)

(Long: 73495828188)

(Long: 73495828188)

-1.png?width=300&height=132&name=Group%20316127847%20(4)-1.png)

(Long: 73495828188)

.png?width=300&height=132&name=Communiqu%C3%A9%20(3).png)

(Long: 73495828188)

.png?width=300&height=132&name=Communiqu%C3%A9%20(3).png)

(Long: 73495828188)

(Long: 73495828188)

.jpg?width=200&height=100&name=Group%20316127846%20(1).jpg)

-1.png?width=200&height=100&name=Group%20316127846%20(2)-1.png)

-1.png?width=200&height=100&name=Group%20316127847%20(4)-1.png)

.png?width=200&height=100&name=Communiqu%C3%A9%20(3).png)

.png?width=200&height=100&name=Communiqu%C3%A9%20(3).png)

.png?width=200&height=100&name=Group%20316127849%20(2).png)