The Federal Law on Financial Services in a nutshell

The Federal Act on Financial Services (hereinafter “FinSA”), which came into force on 1 January 2020, introduces a series of requirements relating to the provision of financial services that help to increase investor protection. The FinSA contains the rules of conduct that financial service providers must respect with regard to their clients in terms of information, verification and documentation.

Piguet Galland sees these new obligations as an opportunity to improve the transparency and protection that its clients already enjoy.

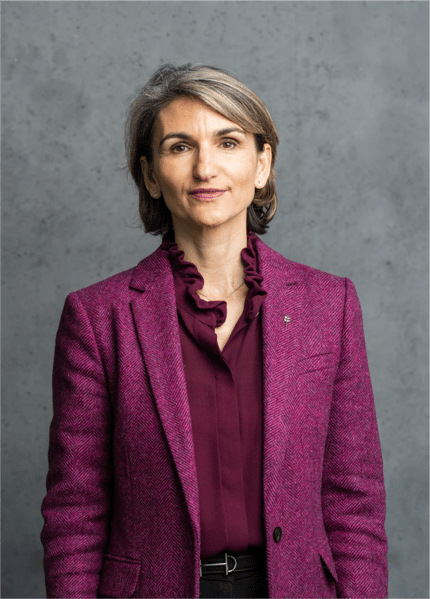

Our Chief Risk Officer, Carine Casteu explains in less than two minutes what this means for our clients in this short video:

Did you say FinSA?

The Financial Services Act, known as FinSA, is a law that aims to protect investors who wish to invest their assets by purchasing financial instruments such as shares, bonds or collective investment funds. Investment services such as management and advisory mandates are fully covered by this law as well as the so-called Lombard loan.

What are the implications?

The important thing is to define with the client his present and future plans, his assets and income, as well as his knowledge and experience of financial services and instruments.

On this basis, Banque Piguet Galland is able to determine an investor profile that corresponds to the client’s risk appetite in order to offer services and products that match this profile.

Finally, emphasis is also placed on the information and transparency that must be provided to clients, whether in terms of the fees applied or the advice offered.

Why is this important?

This law puts the customer at the heart of the system. It encourages a regular dialogue between the bank and its customer to ensure that it is always in tune with the customer’s plans and financial needs. These discussions are rich in information and allow the customer to receive a better service.

The protection of investors and the development of their long-term assets are at the heart of Piguet Galland’s concerns. To find out more, read our brochure about the FinSA here.

Author

-

Carine Casteu has a degree in accounting and finance from Paris Dauphine University and a DAS in Resilience and Organizational Health from the HEG. She began her career at PwC. After working for HSBC Group for 12 years, she joined Piguet Galland as head of compliance and central systems in 2014. In 2016, she was also given responsibility for risk management and legal, becoming Chief Risk Officer and a member of the Executive Committee.

Carine Casteu has a degree in accounting and finance from Paris Dauphine University and a DAS in Resilience and Organizational Health from the HEG. She began her career at PwC. After working for HSBC Group for 12 years, she joined Piguet Galland as head of compliance and central systems in 2014. In 2016, she was also given responsibility for risk management and legal, becoming Chief Risk Officer and a member of the Executive Committee.