Is it better to pledge or withdraw the LPP to finance your home?

-

Arcinfo

-

Alexandra Tudorache Financing Solutions Specialist

This article was written by Alexandra Tudorache, a Financing Solutions Specialist. It appeared in arcinfo, on the 23rd February 2024.

In Switzerland, the dream of homeownership is often accompanied by significant financial challenges: high real estate prices, a minimum down-payment requirement of 20% from personal funds, amortisation within fifteen years of the 2nd rank debt portion, etc. This partly explains the low proportion of homeowners, at 36% (2021 figures, source: FSO) versus 64% of tenants.

When purchasing a primary residence the possibility of using some of the 2nd pillar pension assets in addition to the compulsory 10% of down-payment from personal savings facilitates property acquisition..

As a reminder, the 2nd pillar is a key component of the Swiss retirement-saving system. It is managed by pension funds, and generally composed of equal contributions from the employer and the employee.

An employer can also decide to contribute more than half of the regular pension savings. Any employee at least 17 years old, insured under the 1st pillar (OASI or “Old Age and Survivors Insurance”), earning more than 22,050 francs per year (as of 2023) is required to contribute to the 2nd pillar. Self-employed individuals can also voluntarily insure themselves through a pension fund.

The 2nd pillar savings are intended to ensure a sufficient supplementary income to the OASI (1st pillar) during retirement, yet particularly high property prices in Switzerland and the compulsory minimum 20% down-payment from personal sources are increasingly prompting buyers to use their retirement savings in advance to complete the financing required for the purchase of their primary residence, which is very often the project of a lifetime.

The specific conditions offered by each pension fund vary, however this option offers an interesting alternative by facilitating the constitution of personal funds to reach the required minimum of 20% of the purchase price as a down-payment.

Only up to 50 years old

It is nonetheless important to be aware that when acquiring property after the age of 50 only the retirement-savings contributed up to the age of 50 can be used, either as a capital withdrawal or as a pledge. Also, it is not possible to release 2nd pillar savings for the purchase of a secondary residence or an investment property.

Infographic : Jean-Marie Gallay

Infographic : Jean-Marie Gallay

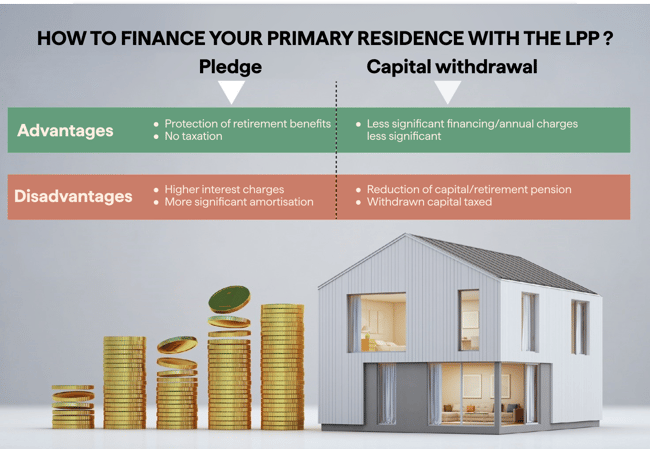

There are two options for the use of 2nd pillar savings: pledging, where the funds remain in your pension fund and are only used as a guarantee, or the withdrawal of the capital. Each option has its advantages and disadvantages. However, it is especially important to do your calculations based on your age at the time of purchase and to choose the most pertinent option in your specific situation.

Withdrawing your assets from your retirement savings will have the immediate consequence of triggering a tax payment that will add to other significant expenses relating to the property purchase, such as notary fees for example.

Another consequence is that this withdrawal will create a reduction in the pension capital that will be available to you at the time of your future retirement, and/or to the potential pension income you will receive. A 40-year-old person acquiring a primary residence will have the necessary time to rebuild their retirement capital, whilst a 50-year-old person will need to make an additional savings effort.

Nevertheless, it will be possible for you to repay all or part of a capital withdrawal at any time back into your 2nd pillar, but no later than the day before retirement, so recovering part of the tax paid. The minimum amount allowed in order to do so is CHF 10,000.

Higher amortisation

Pledging is therefore an attractive option compared to capital withdrawal but also has a disadvantage. Your financing requirement will cost you more in this case, as it will be higher (since there are less equity contributions in the form of cash), implying, de facto, a higher amortisation in order to reduce your debt to a first rank level (2/3 of the value of your real estate held by the secured creditor) within 15 years. This amortisation requirement can rapidly become significant depending on your debt ratio and potentially weigh heavily on your budget.

It is also important to remember that financial institutions may, when using the 2nd pillar, carry out a calculation of the projected expense/income ratio at retirement, to ensure that the financing will still be affordable for the client. If necessary, additional guarantees might be requested, such as a life insurance policy, for example.

In summary, using the 2nd pillar for property acquisition can have significant consequences for your personal finances and their long-term security. It is therefore crucial to fully understand the implications and associated risks before deciding to access retirement savings. In this context, we strongly recommend consulting a mortgage specialist or a pension planning professional in order to obtain personalised advice.