Trump draws the weapon of tariffs

The threat had been looming for some time, but the US president has now taken action. Tariffs have been raised with immediate effect on imports from three of the United States’ key trading partners. The additional duties amount to 25% for Canada and Mexico and 10% for China. Europe, another major exporter to the US, could also be targeted in the short term by a similar measure.

Financial markets are reacting to these announcements. equity indices are under pressure due to the prospect of heightened protectionism, which typically weighs on global growth. In the foreign exchange market, the US dollar is strengthening against all major currencies, as these tariffs could fuel higher inflation in the US and sustain elevated interest rates for the dollar relative to other currencies. During Donald Trump's first term, tariffs were frequently used as a bargaining tool. This resurgence of market volatility could therefore prove temporary if it is once again a tactic aimed at securing concessions.

Commodities : opportunities in 2025

Commodities delivered a performance that was both modest and mixed in 2024. Their average increase of approximately 6% masks significant disparities: certain niche commodities, such as cocoa, tripled in value, while other segments lagged behind. Precious metals, particularly gold, stood out, soaring by an impressive 25%. In contrast, industrial metals and agricultural commodities recorded only modest gains, remaining below 5%. Meanwhile, the energy sector declined over the year, weighed down by weaker fundamentals.

Looking ahead to 2025, gold remains one of our high-conviction investments. Structural demand from central banks continues to provide it with strong support. While the strength of the US dollar acts as a headwind, its impact on gold is far more subdued than in the past. Additionally, the recent market consolidation has helped absorb the excess optimism seen in October. Given the heightened uncertainties surrounding global trade and the impact of US tariffs, we believe gold remains attractive due to its safe-haven status.

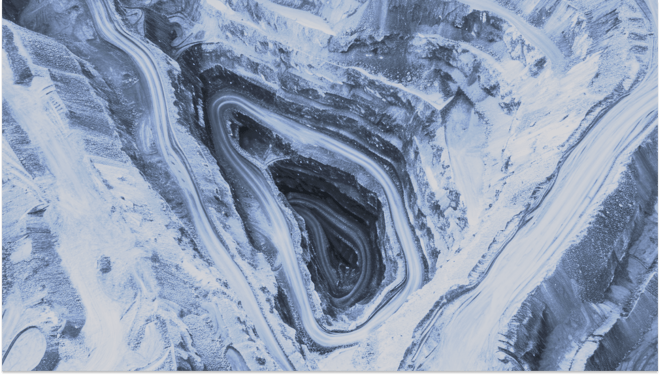

Beyond gold, we identify several compelling opportunities. Copper, first and foremost, is emerging as a strategic asset. The energy transition and the increasing electrification of the global economy imply structurally strong demand for this metal. However, supply is struggling to keep pace due to a lack of major new developments. Despite this underlying imbalance, the market remains in a wait-and-see mode. We are closely monitoring this segment to identify an attractive entry point. Uranium also presents significant potential. While nuclear energy remains a topic of debate, it is gaining traction as a reliable and clean energy solution, especially in light of the challenges posed by the intermittent nature of renewable energy sources. Following strong gains in recent years, uranium prices underwent a phase of consolidation in 2024. In the short term, we remain cautious, as ongoing negotiations for a potential ceasefire in Ukraine could allow Russia, a major uranium producer, to resume its exports. While this scenario remains uncertain, it could create an attractive buying opportunity.

Given these various factors, the outlook for commodities appears positive.

This week’s figure: 2.75%

The European Central Bank’s new rate level following a 0.25% cut. The move was widely expected. However, markets have likely not fully priced in the forthcoming rate cuts, which, in our view, could be more significant than the forecasts of leading economists suggest.

Author

-

A graduate of the University of Geneva in mathematics, Léonard Dorsaz joined the banking sector and specialised in the selection of funds, more particularly alternative funds. He joined Piguet Galland in 2004, where he heads the department in charge of selecting and monitoring external products and has managed the Piguet Opportunity Fund since 2008. He holds the CIIA diploma.

A graduate of the University of Geneva in mathematics, Léonard Dorsaz joined the banking sector and specialised in the selection of funds, more particularly alternative funds. He joined Piguet Galland in 2004, where he heads the department in charge of selecting and monitoring external products and has managed the Piguet Opportunity Fund since 2008. He holds the CIIA diploma.