When it comes to managing your investment portfolio, one of the key concepts to grasp is the need for rebalancing it. This process helps you maintain your initial strategy and reduce the potential risks associated with market fluctuations.

Rebalancing: A Definition

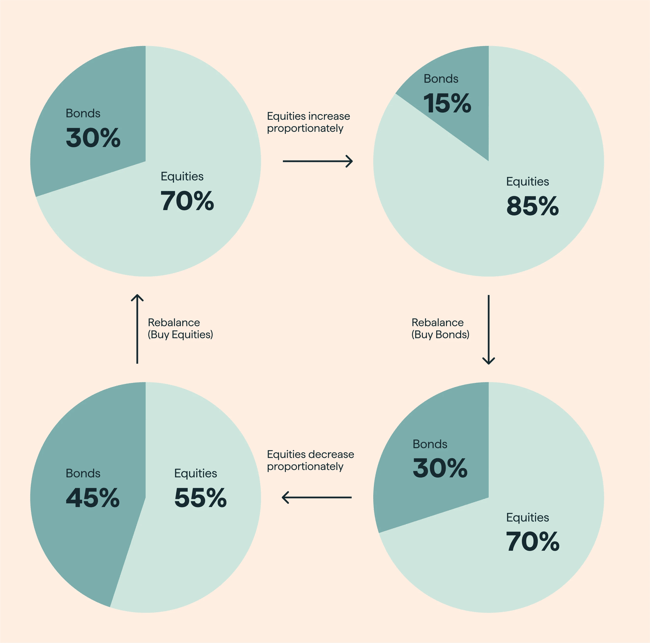

Rebalancing your investment portfolio involves selling or buying a category of financial instruments to preserve your initial asset allocation strategy.

An Example of Rebalancing

Let’s take the example of an asset allocation that assigns 60% of the portfolio to equities and 40% to bonds.

After a certain period, the value of your individual allocation pools may have shifted. For instance, the value of the equities could have increased more than the bonds held in the portfolio, resulting in an allocation of 68% in equities and 32% in bonds. To rebalance your portfolio, you would need to sell some equities and buy more bonds.

Why Rebalance Your Portfolio?

Rebalancing your investment portfolio is crucial to maintain your strategy and perpetuate your initial investment objective.

If the allocation of equities, which are more volatile, represents a larger portion of your portfolio than intended, your portfolio becomes riskier. Conversely, if your equity allocation decreases, you'll have a more conservative portfolio. In either case, an adjustment becomes necessary.

It's also worth noting that this allocation adjustment can be done among subcategories of your portfolio, such as between different industries your stocks cover (technology, health, energy), or different segments of the bond market (European bonds, American bonds, sovereign bonds, corporate bonds, etc.).

When and how to readjust your asset allocation?

There are two methods you can use to decide when the time is right to rebalance your portfolio.

- Rebalancing based on a schedule: this could be once a month, once a quarter or once a year, for example. Although easy to follow and implement, this may not always be necessary, or may happen too late depending on market fluctuations.

- Threshold-based rebalancing: this may be when the actual asset allocation exceeds your initial strategy by a given percentage – for example 5%. While this makes the portfolio more agile, the transaction costs involved can be higher.

Our experts will be delighted to guide you and answer any questions you may have about responsible investment and its various components. Contact us!

Examples of asset allocation and rebalancing: