The 360 Series

Secondary residences and taxes

In Switzerland, taxes on your second home are similar to those on your primary residence. Taxes are collected by the canton in which the property is located.

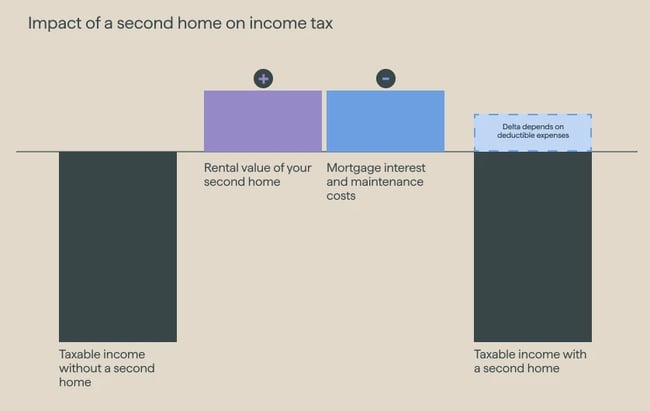

The property's rental value must be declared as income. This value (not to be confused with the actual rental income) is calculated based on the theoretical rent that could be received if the house were rented out, according to market prices and cantonal rules.

The tax value is added to your assets.

Some cantons allow you to deduct taxes for wear and tear caused by renting your second home. In all cases, mortgage interest and some renovation work are deductible, the same as for a primary residence.

The rental value of a second home is taxed as income. This also applies if the weather conditions do not allow the property to be used all year round, for example, due to snowfall or avalanche warnings.

Ready to take the plunge?

Our experts can help you with all your financing needs.

Although it's subject to taxes in the country where it's located when acquiring a second home abroad, it's also mandatory to declare it in Switzerland. This is because Switzerland does not apply any tax on second homes abroad, but their value is taken into account when determining the wealth and income tax rate.

How the tax value is determined varies from canton to canton. Some cantons use the purchase price from the date of purchase (Geneva), while others use the average rate for the year of purchase (Neuchâtel), or some have an allowance (Vaud).

Given the complexity of these tax issues, it makes sense to seek professional advice. Our wealth and estate planning experts can help you with your projects at every stage of your life and find the solution that suits you best.

The next episode will offer a captivating exploration of the best places to invest in. Get expert advice and choose the most promising destinations.

The 360 series second home

Piguet Galland has developed the 360 series to give you all the necessary information to make your plans a reality. This comprehensive series discusses all the major topics you may have questions about. Each series consists of 5 episodes, providing you with the keys you need to ensure your projects are a success.

-

Episode #1

A second home within reach

Make your holiday home dreams come true

-

Episode #2

Financing your dream second home

Explore financing and define your budget

-

Episode #3

Second homes and taxes

Discover the impact of a second home on your taxes

-

-

Episode #5

Rental management and maintenance

The keys to a well-maintained property

Financing solutions

Our financing solutions allow you to maximize the growth of your wealth and realize your projects with peace of mind.

What our clients say about us.

-

Piguet Galland offered us a number of different scenarios to help us through this major change in life, retirement.

Noémie Prod'hom

-

Happiness is knowing that I have someone who will bring their expertise to advise me and ensure my life is carefree.

Marie-Laure Favre

-

At Piguet Galland, the human factor takes center stage. We genuinely listen to understand and provide solutions, not merely to sell."

M’Bayang Thiam

-

I wanted to purchase and renovate a house through an auction, which required immediate payment. Fortunately, your company performed exceptionally well."

David Vuadens

-

Piguet Galland is the financial partner that's close to my heart. I have complete trust in them. In this bank, you get to know them on a personal level, and that's of utmost importance."

Ann Evard

-

The aspect of the Bank that resonated with me in the past and to this day is trust, which is conveyed through a sense of closeness and, most importantly, a dedicated point of contact."

Anthony Picard

-

What I value most about Piguet Galland is the service and the trust-based relationship I have built with the various advisors I have worked with over the past thirteen years, all of whom have consistently been excellent."

Dominique Lauener

-

Throughout the years of building a trusting relationship with Piguet Galland, I have realized that a bank can be a lifelong partner for significant milestones."

Franck Neveu

Seek financing for the purchase of a holiday home

Ready to take the plunge? Our experts can help you with all your financing needs.