The 360 series

The magic formula for the best price

Are you wondering the maximum amount you can invest in your future home? There's nothing very complicated about determining this amount: just consider two key factors. The first is your gross annual income, and the second is your available equity.

How do you know how much equity you have?

Equity capital is your personal financial resources. This includes your savings and your occupational or private pension capital, i.e. your 2nd and 3rd pillars, as well as any inheritance advances or donations.

To obtain financing, you must pay at least 20% of the property's value from your own funds. By law, you must have at least 10% of your own funds from savings. The remaining 10% can come from your occupational pension provision.

And what about the rest?

Generally speaking, banks can finance up to 80% of the value of your property with two types of mortgages: a first-ranking mortgage and a second-ranking mortgage.

This means that you will have a 1st and 2nd ranking mortgage, as the amortisation is different for each part of this mortgage. It's not mandatory to repay the 1st mortgage in full. The 2nd mortgage, however, must be repaid in full within 15 years. The repayment schedule is therefore calculated to achieve this objective.

The 1st mortgage can finance up to 65% of the property's value.

The second mortgage will finance 13.4% of the property's value and must be amortised within 15 years or before your retirement, whichever comes first.

Security guaranteed

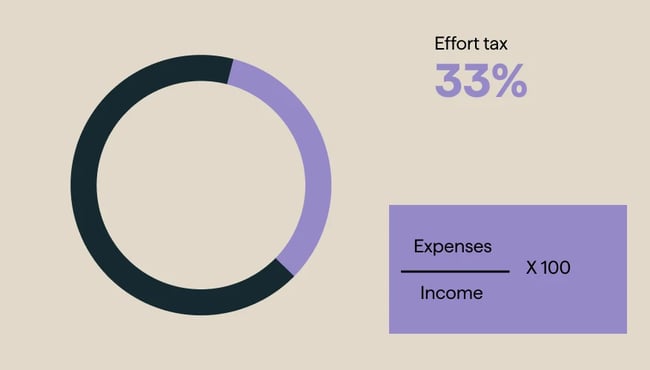

The basic principle for assessing your property’s financial viability is that the costs associated with your property should generally not exceed 33% of your gross income. These costs include the theoretical interest of around 5%, depreciation, and property maintenance costs.

We're talking about the effort ratio, an important criterion used to determine your needs in terms of financing. This rate represents the ratio between the annual sum of charges (notional interest, amortisation, and property maintenance costs) and your total gross income. Let’s say your gross annual income is CHF 250,000. Your total repayment charges should not exceed CHF 82,500 a year. However, note that this ratio may vary depending on the situation and the financial institution.

Now that you know how to calculate your maximum purchase price, you can take the next steps. The next step is finding the right financing for each project.

Ready to take the plunge?

Our experts can help you with all your financing needs.

The primary residence series

Piguet Galland has developed the 360 series to give you all the necessary information to make your plans a reality. This comprehensive series discusses all the major topics you may have questions about. Each series consists of 5 episodes, providing you with the keys you need to ensure your projects are a success.

-

Episode #1

Buying a home: a winning decision

Guide your homeownership dreams with this series.

-

Episode #2

Knowing what you want

Creating your own home requires a major investment. Think carefully about your needs and desires.

-

Episode #3

The magic formula for the best price

Determine the maximum amount you can consider for acquiring your primary residence based on your financial situation.

-

Episode #4

The right financing for your project

From standard mortgages to Lombard loans. Explore all the specifics of fixed, variable and Saron rates.

-

Episode #5

Taxes when you purchase a property

Becoming a homeowner is a significant step but comes with specific tax responsibilities. Buying property has various financial implications in terms of tax.

Financing solutions

Our financing solutions allow you to maximize the growth of your wealth and realize your projects with peace of mind.

What our clients say about us.

-

Piguet Galland offered us a number of different scenarios to help us through this major change in life, retirement.

-

Happiness is knowing that I have someone who will bring their expertise to advise me and ensure my life is carefree.

-

At Piguet Galland, the human factor takes center stage. We genuinely listen to understand and provide solutions, not merely to sell."

-

I wanted to purchase and renovate a house through an auction, which required immediate payment. Fortunately, your company performed exceptionally well."

-

Piguet Galland is the financial partner that's close to my heart. I have complete trust in them. In this bank, you get to know them on a personal level, and that's of utmost importance."

-

The aspect of the Bank that resonated with me in the past and to this day is trust, which is conveyed through a sense of closeness and, most importantly, a dedicated point of contact."

-

What I value most about Piguet Galland is the service and the trust-based relationship I have built with the various advisors I have worked with over the past thirteen years, all of whom have consistently been excellent."

-

Throughout the years of building a trusting relationship with Piguet Galland, I have realized that a bank can be a lifelong partner for significant milestones."

Ready to take the plunge?

Ready to take the plunge? Our experts can help you with all your financing needs.