The 360 series

The right financing for your project

From standard mortgages to Lombard loans. Explore all the specifics of fixed, variable and Saron rates.

Financing can initially seem very complicated, but it is a lot easier to understand with a bit of basic knowledge. When you're thinking about buying a home or taking on a mortgage, talking about finances is inevitable. The key lies in choosing the solution best suited to your needs.

Mortgages

Fixed-rate mortgages

Fixed-rate mortgages are popular in Switzerland. They offer greater security and are not affected by rising rates. However, you won't be able to take advantage of cut rates. These mortgages have a fixed interest rate and a fixed term, usually between one and ten years.

Although they can be terminated by paying a fee before maturity, fixed-rate mortgages are popular for those seeking financial stability. In Switzerland, four out of five mortgages are of the fixed-rate type.

Variable rate mortgages

A variable-rate mortgage has no fixed term and a variable interest rate. It can usually be terminated with six months' notice. This option offers considerable flexibility, allowing borrowers to benefit from potential downward fluctuations in interest rates. However, it also exposes borrowers to uncertainty if rates rise. The variable-rate mortgage is particularly suitable for those looking for flexibility in their mortgage repayment plan.

The Saron mortgage

Short-term or SARON mortgages take advantage of low or falling interest rates. However, you must be prepared to accept upward fluctuations. SARON is an interest rate based on actual transactions. Unlike variable-rate mortgages, SARON mortgages generally have a three-month fixed term. This option combines flexibility and speed.

Understanding a mortgage

A mortgage is a loan granted to a buyer by a bank, insurance company, pension fund, or even a private individual. In exchange, the buyer pledges the property to the creditor. This pledge is formalised in a "cédule hypothécaire" (Mortgage certificate). If the buyer fails to meet their obligations, for example, by not paying interest rates or not repaying the loan, the creditor has the right to seize the property and sell it to recover their money.

A cédule hypothécaire is drawn up by a notary based on the information provided by the pledgee (bank, insurance company, etc.).

For example, if they agree to finance a 500,000 francs loan to purchase a flat, they transfer this amount to the notary, who draws up the notarial act. The notary's fees are payable by the buyer in accordance with regulated rates.

Piguet Galland is delighted to provide you with a personalised approach, including an estimate of your property, direct contact with the notary, drafting the mortgage act for the guaranty, and finally, the act of purchase. We offer you simplified administration and comprehensive advice throughout the entire process.

Controlling the cost of your mortgage

The cost of a mortgage is a complex equation, but understanding it is crucial to thorough financial management. Several variables come into play in this assessment.

The interest rate occupies a key role: its increase translates to an increase in the total cost of taking out a loan. The loan amount is also crucial.

As this increases, so do the payments and the overall cost of taking out a loan. And let's not forget the costs associated with the loan, such as notary fees, administration fees and insurance, which can considerably impact the total cost. Develop a suitable strategy to pay off your mortgage in the best possible way.

Direct amortisation

Direct repayment, where you repay a fixed amount on a regular basis, reduces your debt and interest burden. Careful planning is essential to optimise your repayment strategy and maximise your tax benefits.

Indirect amortisation

Indirect amortisation means that the original mortgage debt remains, while the amortisation amount is paid via a private pension solution, such as pillar 3a or 3b.

This guarantee gets some return if it is linked to an investment fund. Upon retirement, the capital is paid out, repaying the mortgage in full.

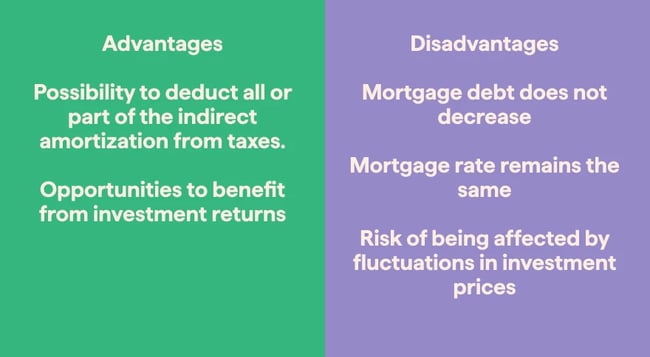

Pros and cons of indirect amortisation: Although this strategy does not directly impact your mortgage debt, it offers attractive tax deductions. Make sure you carefully understand every aspect before optimising your financial plan.

Lombard Loans

The Lombard Loan is a form of secured fixed-rate financing granted in exchange for liquid assets, such as shares, bonds, or investment funds, up to a certain percentage of their value.

Lombard loans and mortgages are different financing solutions tailored to specific needs.

The best option for you will depend on your financial objectives, assets, and ability to repay the loan. Our financing solutions experts will assess the solution that best suits your situation, goals, and needs. They will work out a tailor-made solution for you, combining and matching different financial solutions to optimise your investment in the best possible way.

In the final episode of our series, we look at the tricky subject of property tax. Find out all about the ins and outs of taxes, and, above all, don't miss our advice on how to make the most of this burden.

Ready to take the plunge?

Our experts can help you with all your financing needs.

The primary residence series

Piguet Galland has developed the 360 series to give you all the necessary information to make your plans a reality. This comprehensive series discusses all the major topics you may have questions about. Each series consists of 5 episodes, providing you with the keys you need to ensure your projects are a success.

-

Episode #1

Buying a home: a winning decision

Guide your homeownership dreams with this series.

-

Episode #2

Knowing what you want

Creating your own home requires a major investment. Think carefully about your needs and desires.

-

Episode #3

The magic formula for the best price

Determine the maximum amount you can consider for acquiring your primary residence based on your financial situation.

-

Episode #4

The right financing for your project

From standard mortgages to Lombard loans. Explore all the specifics of fixed, variable and Saron rates.

-

Episode #5

Taxes when you purchase a property

Becoming a homeowner is a significant step but comes with specific tax responsibilities. Buying property has various financial implications in terms of tax.

Financing solutions

Our financing solutions allow you to maximize the growth of your wealth and realize your projects with peace of mind.

What our clients say about us.

-

Piguet Galland offered us a number of different scenarios to help us through this major change in life, retirement.

Noémie Prod'hom

-

Happiness is knowing that I have someone who will bring their expertise to advise me and ensure my life is carefree.

Marie-Laure Favre

-

At Piguet Galland, the human factor takes center stage. We genuinely listen to understand and provide solutions, not merely to sell."

M’Bayang Thiam

-

I wanted to purchase and renovate a house through an auction, which required immediate payment. Fortunately, your company performed exceptionally well."

David Vuadens

-

Piguet Galland is the financial partner that's close to my heart. I have complete trust in them. In this bank, you get to know them on a personal level, and that's of utmost importance."

Ann Evard

-

The aspect of the Bank that resonated with me in the past and to this day is trust, which is conveyed through a sense of closeness and, most importantly, a dedicated point of contact."

Anthony Picard

-

What I value most about Piguet Galland is the service and the trust-based relationship I have built with the various advisors I have worked with over the past thirteen years, all of whom have consistently been excellent."

Dominique Lauener

-

Throughout the years of building a trusting relationship with Piguet Galland, I have realized that a bank can be a lifelong partner for significant milestones."

Franck Neveu

Ready to take the plunge?

Ready to take the plunge? Our experts can help you with all your financing needs.