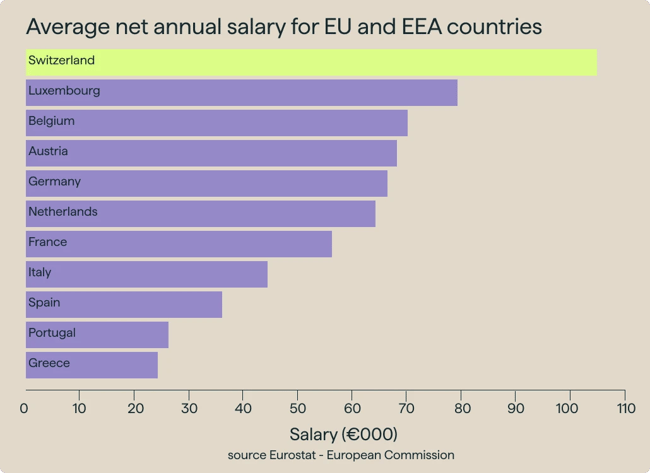

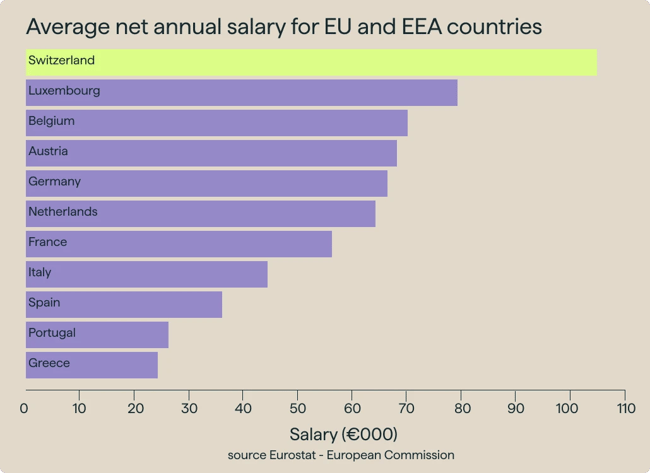

As a private individual

Switzerland positions itself as a preferred destination for individuals seeking to develop their careers and benefit from advantageous tax conditions. As a Swiss resident, you operate in a dynamic economic environment conducive to professional growth. Swiss companies, leaders in various sectors ranging from finance to technology, offer a wide range of professional opportunities.

Taxation

Furthermore, Switzerland stands out for its attractive tax system for individuals. With competitive tax rates and favourable tax regulations, Swiss residents can optimize their tax situation while enjoying high-quality public services and well-developed infrastructure.

Lump-Sum Taxation

Lump-sum taxation, also known as expenditure-based taxation, allows you to benefit from a special tax treatment. Indeed, you will not be taxed based on your income but on your expenses, particularly those related to your housing.

The lump-sum taxation system is based on the taxpayer's lifestyle and expenses in Switzerland, rather than their actual income and wealth. The minimum expense considered for cantonal and federal taxes amounts to seven times the rent or the rental value of your home. Only those with an annual income of at least 400,000 Swiss francs can benefit from this tax privilege concerning direct federal tax.

This form of taxation is offered to foreign nationals who, for the first time or after an absence of at least ten years, take up residence in Switzerland and do not engage in any gainful activity there.

The lump-sum tax option offers several advantages. The most important one is tax predictability. This tax status guarantees fixed annual taxation, based on the taxpayer's expenses.

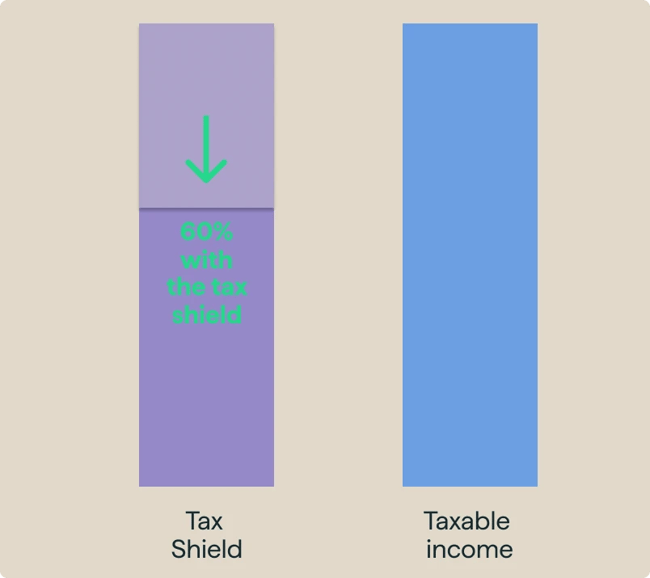

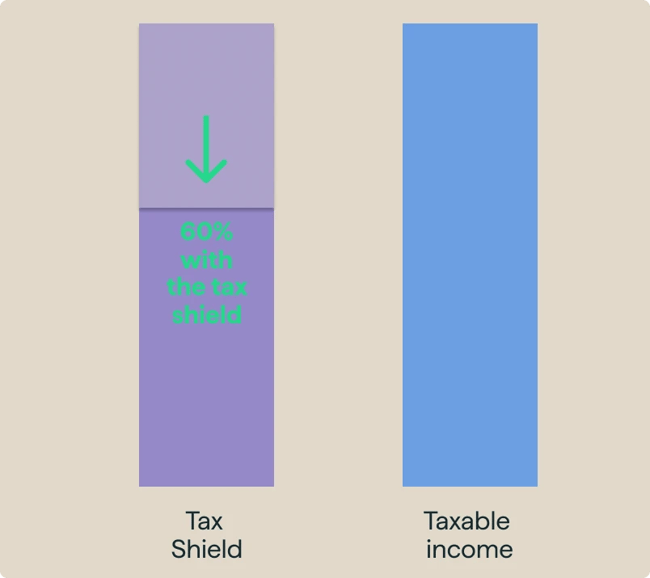

The Tax Shield

The tax shield is designed to alleviate the wealth tax burden when it is considered excessively onerous for the taxpayer. Essentially, it caps the wealth tax so that, when combined with cantonal and communal income taxes, it does not exceed a specified percentage of the taxpayer's income. This anti-confiscatory measure is implemented in various cantons, including Geneva, Vaud, Valais, and Bern.

In Geneva and Vaud, wealth, and income taxes, including additional cantonal and communal taxes, cannot exceed 60% of the net taxable income. However, for this calculation, the net return on wealth must represent at least 1% of the net wealth. This net return on wealth includes income from movable and immovable assets, after deducting expenses such as interest on debts and banking fees. Additionally, interest on taxable commercial wealth is considered, while respecting a limit corresponding to the net income in terms of self-employed activities.

For example, let’s consider a person with an annual income of 100,000 CHF and a wealth of 10 million CHF. Even if the wealth tax is only 1%, this already represents a tax burden of 100,000 CHF, which is equivalent to 100% of their annual income. Thanks to the tax shield, their total tax burden, combining income and wealth, cannot exceed 60% of their income, i.e., 60,000 CHF.

The maximum burden for spouses living together is calculated based on the total of their wealth and income elements. The taxes considered in this calculation include the cantonal and communal income tax as well as the cantonal and communal wealth tax, while the personal tax, additional real estate tax, and other taxes are not included.

If the tax shield mechanism applies, the reduction applies to the wealth tax, including additional cantonal and communal taxes.

Double Taxation Conventions

Double Taxation Conventions (DTCs) aim to prevent the income or wealth of individuals or legal entities with foreign ties from being subject to tax twice. These conventions are therefore a key element in promoting economic activities on the international stage. Switzerland has concluded more than 100 such agreements so far and is striving to further expand this network. In summary, Switzerland offers attractive tax benefits.

Each situation is unique, and our experts are here to guide you towards the best options for tax optimization. Feel free to contact us for personalized advice.